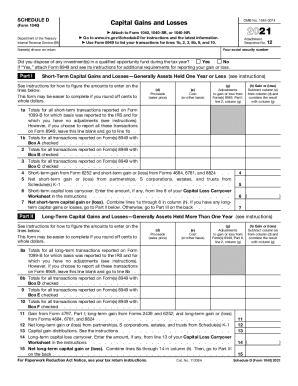

Irs 2024 Schedule D

Irs 2024 Schedule D – Crypto losses or gains are reported on your personal tax form like any other capital gains tax, including options to offset a tax liability. . Capital gains are the profit you make when you sell a capital asset (such as real estate, furniture, precious metals, vehicles, collectibles or major equipment) for more money than it cost you. The .

Irs 2024 Schedule D

Source : kdvr.comForm 1040 For IRS 2024 | How To Fill Out Schedule A B C D

Source : nsfaslogin.co.zaWhat Is Schedule D: Capital Gains and Losses?

Source : www.investopedia.comFree Tax Clinic Bethpage VITA at Touro Law University – Nassau

Source : www.nslawservices.orgWhen To Expect My Tax Refund? IRS Refund Calendar 2024

Source : thecollegeinvestor.comCapital Gains and Losses Schedule D (Form 1065) Fill Online

Source : 1065-d.pdffiller.comForm 1040 For IRS 2024 | How To Fill Out Schedule A B C D

Source : nsfaslogin.co.zaIRS Schedule D (1040 form) | pdfFiller

Source : www.pdffiller.comNorth Miami Public Library

Source : www.facebook.comIRS 1065 Schedule D 1 2011 2024 Fill out Tax Template Online

Source : www.uslegalforms.comIrs 2024 Schedule D New IRS Schedule D Tax Form Instructions and Printable Forms for : If you haven’t filed your taxes yet, now’s the time to get your important tax documents together from employers, mortgage companies, investment firms and more. While Tax Day is still two months away, . The 2024 tax season has begun. The IRS has started receiving and processing tax returns, and the government agency is reminding everyone to file before the April 15 deadline. For those who submit .

]]>

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-bce9771cbe94498ab34d6b9107e208de.png)